Dpad What Is

Dpad What Is - Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Information about form 8903, domestic. Form 8903 is used to figure your domestic production activities deduction (dpad). The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the.

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Form 8903 is used to figure your domestic production activities deduction (dpad). Information about form 8903, domestic.

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 is used to figure your domestic production activities deduction (dpad). Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Information about form 8903, domestic.

Dpad

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Information about form 8903, domestic. Form 8903 is used to figure your domestic production activities deduction (dpad). Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted.

FileDpad.svg ARMS Institute, the ARMS Wiki

Information about form 8903, domestic. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Form 8903 is used to figure your domestic production activities deduction (dpad). The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the.

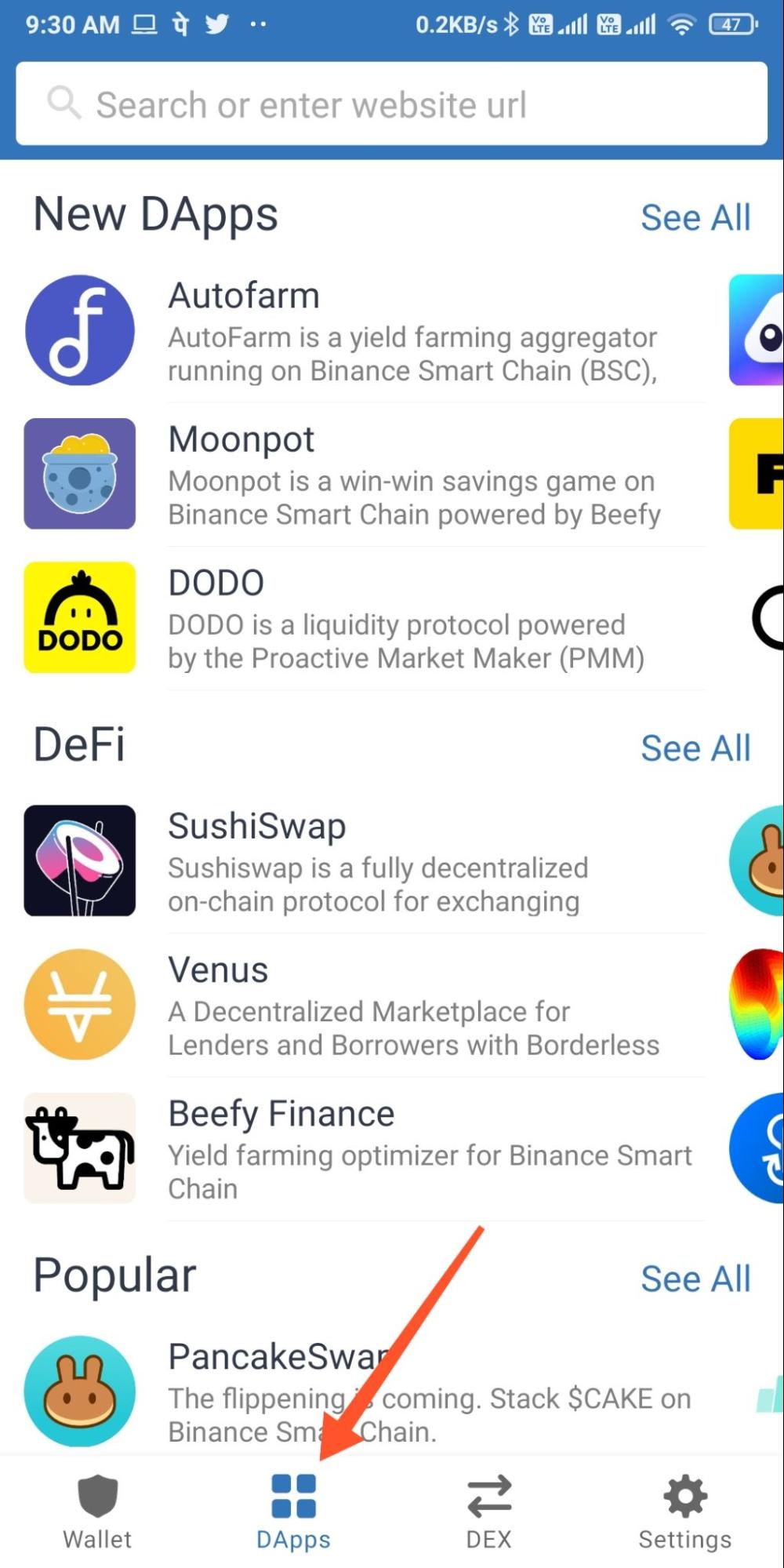

Dpad_Up newskigame

Information about form 8903, domestic. The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 is used to figure your domestic production activities deduction (dpad). Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted.

Dpad USB Hub 8BitDo

Form 8903 is used to figure your domestic production activities deduction (dpad). The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Information about form 8903, domestic.

Dpad

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Form 8903 is used to figure your domestic production activities deduction (dpad). Information about form 8903, domestic.

cohost! dpad

Form 8903 is used to figure your domestic production activities deduction (dpad). Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Information about form 8903, domestic. The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the.

My Dpad Logo Big My Dpad

Information about form 8903, domestic. The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 is used to figure your domestic production activities deduction (dpad). Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted.

Dpad USB Hub 8BitDo

Form 8903 is used to figure your domestic production activities deduction (dpad). The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Information about form 8903, domestic. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted.

Dpad icon svg png free download

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Form 8903 is used to figure your domestic production activities deduction (dpad). Information about form 8903, domestic.

My Dpad My Dpad

Form 8903 computes the dpad, which is generally 9% of the smaller qualified production activity income (qpai), or adjusted. Form 8903 is used to figure your domestic production activities deduction (dpad). Information about form 8903, domestic. The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the.

Form 8903 Computes The Dpad, Which Is Generally 9% Of The Smaller Qualified Production Activity Income (Qpai), Or Adjusted.

The dpad is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the. Information about form 8903, domestic. Form 8903 is used to figure your domestic production activities deduction (dpad).