Liberalized Remittance Scheme

Liberalized Remittance Scheme - The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial.

The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial.

Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign.

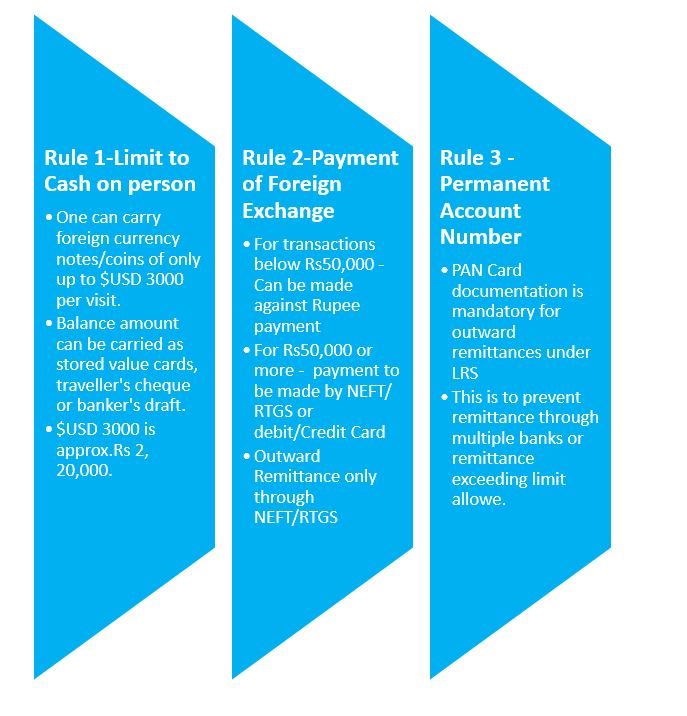

Liberalized Remittance SchemePurposeLimitsRules

Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make.

What is Liberalized Remittance Scheme (LRS)? The Right Stake

The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000.

Liberalized Remittance Scheme (LRS) Rules for foreign remittances

Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions.

Liberalized Remittance Scheme UPSC Archives IAS NEXT 1 BEST IAS/PCS

The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current.

Liberalized Remittance Scheme PDF Reserve Bank Of India Remittance

Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions.

Liberalized Remittance Scheme (LRS) Unimoni.in

The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian.

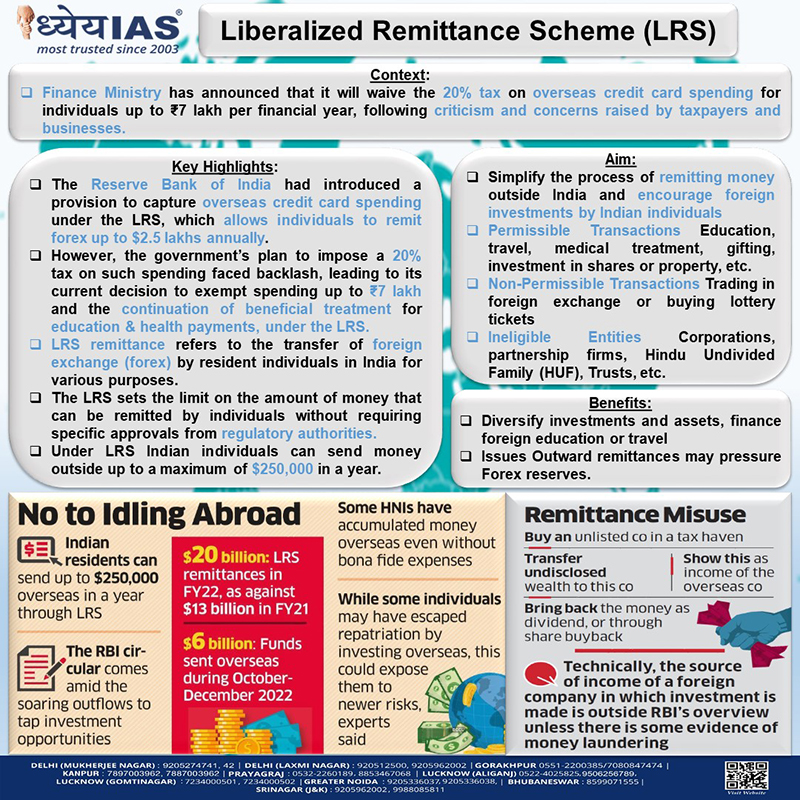

Infopaedia Liberalized Remittance Scheme (LRS) Dhyeya IAS® Best

Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian.

Liberalized Remittance Scheme or LRS an overview Emenbee

The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to.

Liberalized Remittance Scheme (LRS) » Legallands LLP

Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both. Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make.

Liberalized Remittance SchemePurposeLimitsRules

The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. The liberalised remittance scheme (lrs) is a set of regulations put forth by the reserve bank of india (rbi) that allows indian residents to remit. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current.

The Liberalised Remittance Scheme (Lrs) Is A Set Of Regulations Put Forth By The Reserve Bank Of India (Rbi) That Allows Indian Residents To Remit.

Under the liberalised remittance scheme, all resident individuals, including minors, are allowed to freely remit up to usd 2,50,000 per financial. The same year, rbi introduced the liberalised remittance scheme ('lrs'), allowing indian residents to make individual foreign. Lrs is a scheme that allows resident individuals to remit up to usd 2,50,000 per fy for current or capital account transactions or both.