Multiple Llc Can Add My Kid All Of Them

Multiple Llc Can Add My Kid All Of Them - From a liability standpoint, why expose. Many tax professionals will add children or other family members onto the business records for tax reasons. However, given kiddie tax rates (even with the. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. Yes, a minor can own shares in an s corporation or generally own interest in an llc. The logic here is that the.

However, given kiddie tax rates (even with the. From a liability standpoint, why expose. Many tax professionals will add children or other family members onto the business records for tax reasons. The logic here is that the. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. Yes, a minor can own shares in an s corporation or generally own interest in an llc.

However, given kiddie tax rates (even with the. The logic here is that the. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. From a liability standpoint, why expose. Yes, a minor can own shares in an s corporation or generally own interest in an llc. Many tax professionals will add children or other family members onto the business records for tax reasons.

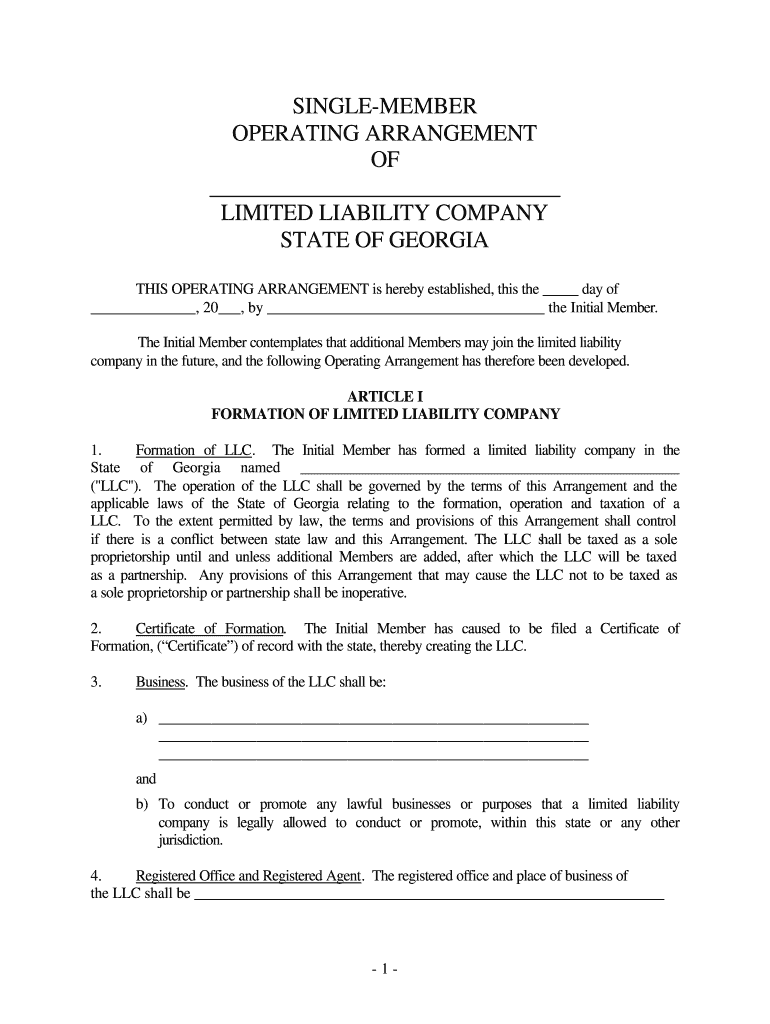

llc operating agreement requirements LLC Bible

Many tax professionals will add children or other family members onto the business records for tax reasons. However, given kiddie tax rates (even with the. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. From a liability standpoint, why expose. Yes, a minor can own shares in an.

11 Ways to Have Multiple Businesses Under One LLC wikiHow

Yes, a minor can own shares in an s corporation or generally own interest in an llc. The logic here is that the. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. From a liability standpoint, why expose. However, given kiddie tax rates (even with the.

LLC Types

Many tax professionals will add children or other family members onto the business records for tax reasons. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. From a liability standpoint, why expose. Yes, a minor can own shares in an s corporation or generally own interest in an.

Game Jolt Share your creations

Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. However, given kiddie tax rates (even with the. Many tax professionals will add children or other family members onto the business records for tax reasons. Yes, a minor can own shares in an s corporation or generally own interest.

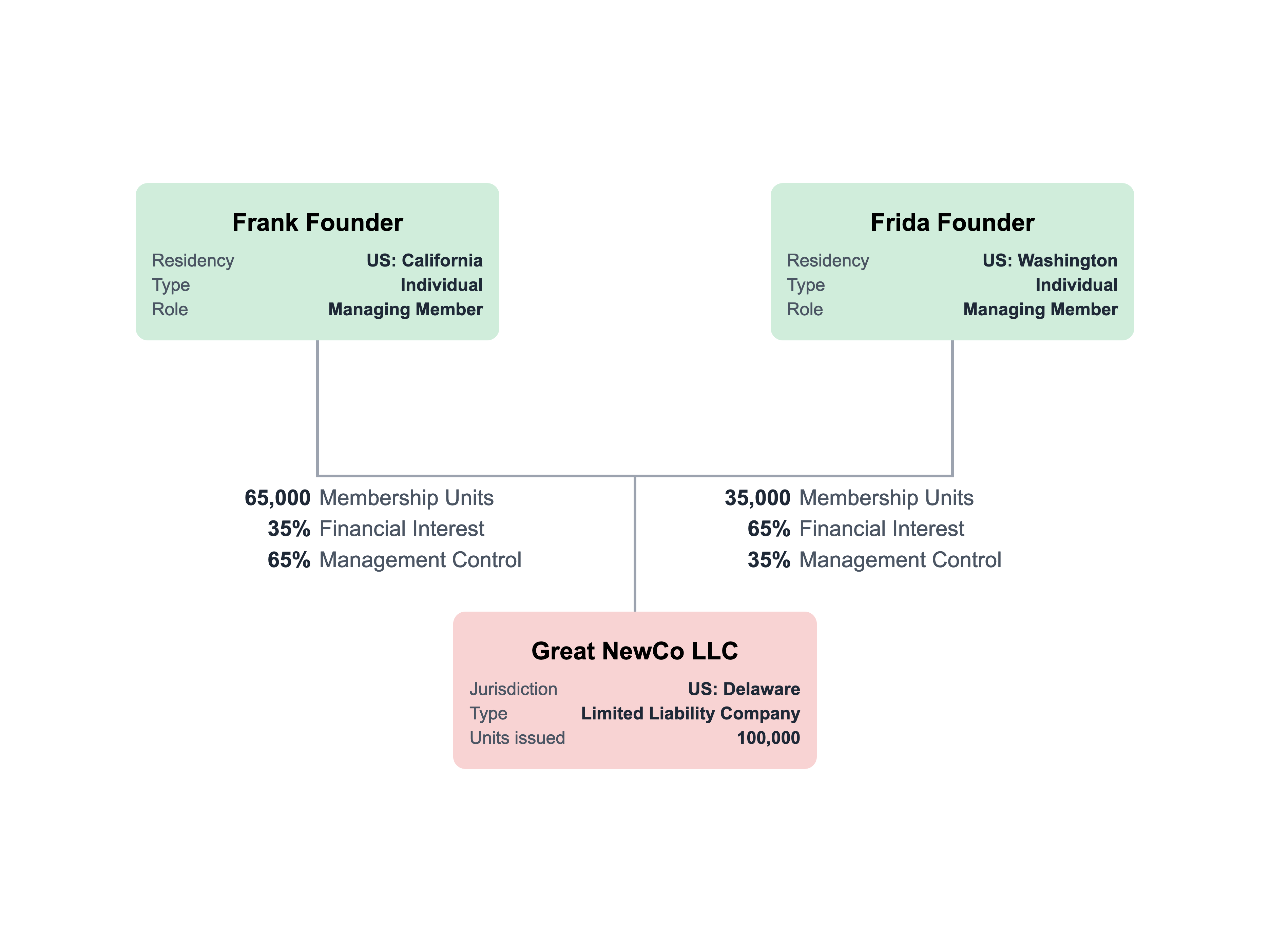

Can an LLC Own Another LLC? Tailor Brands

Yes, a minor can own shares in an s corporation or generally own interest in an llc. However, given kiddie tax rates (even with the. From a liability standpoint, why expose. Many tax professionals will add children or other family members onto the business records for tax reasons. The logic here is that the.

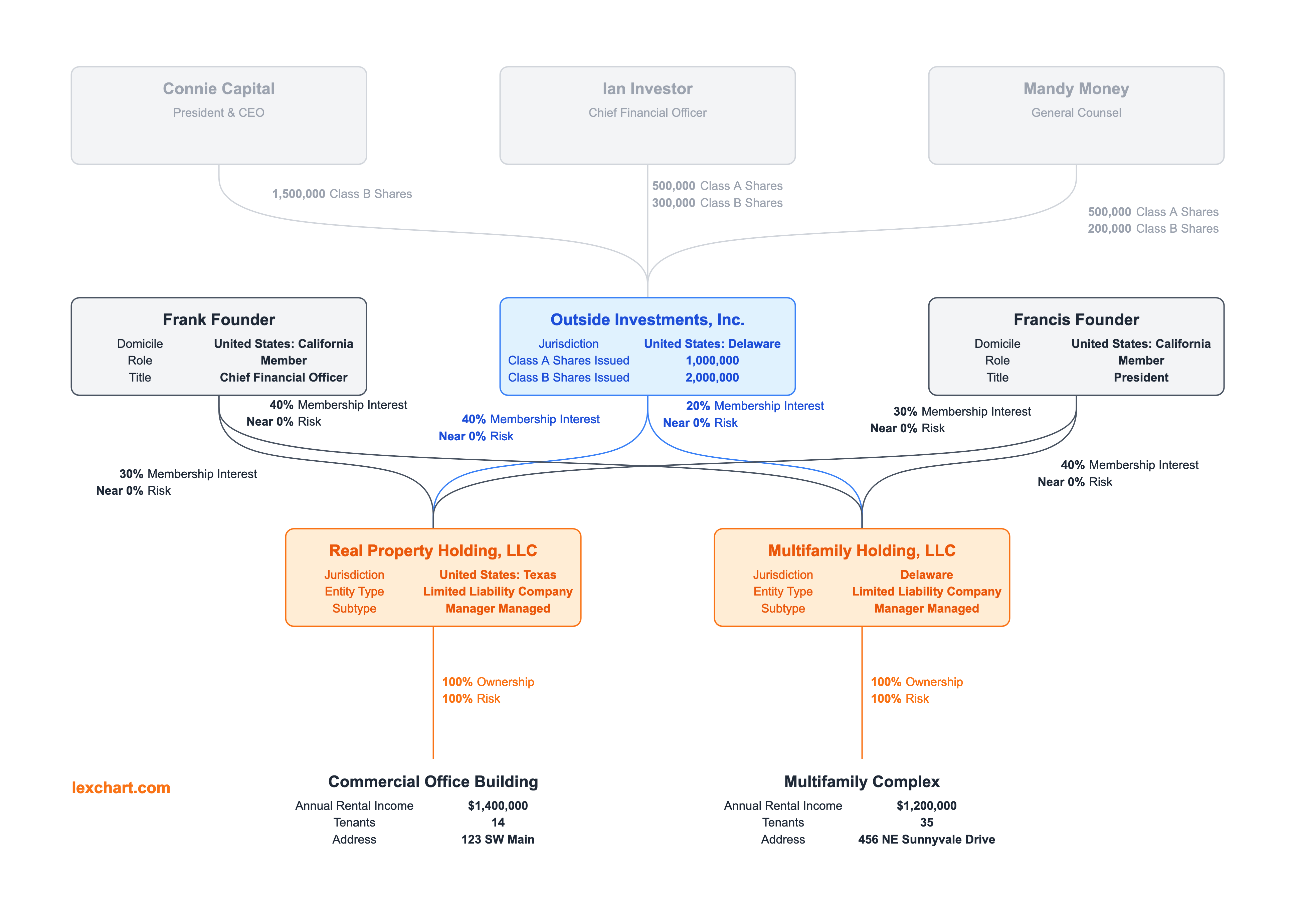

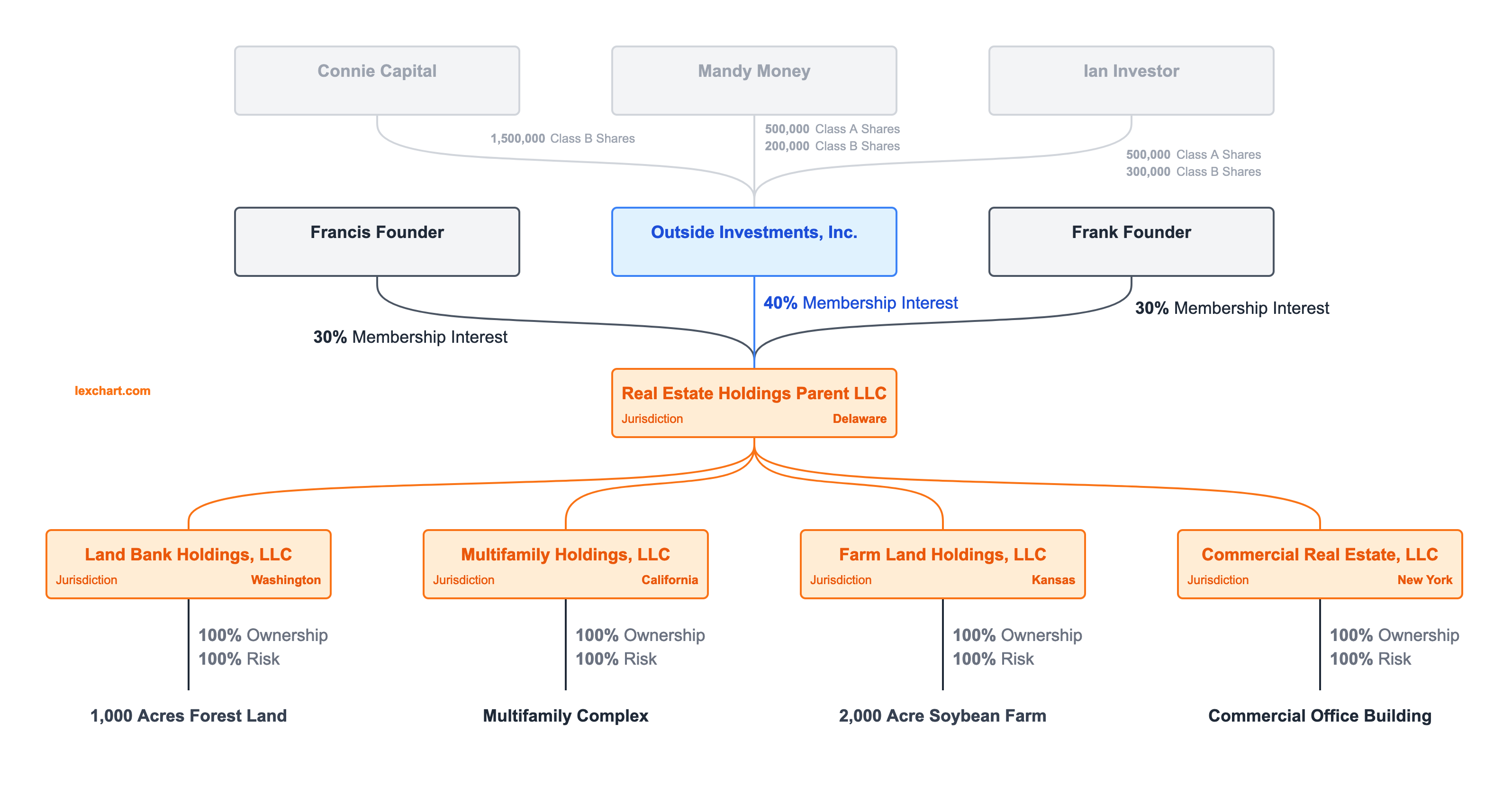

Org Chart Template for Multiple LLCs for Real Estate

Many tax professionals will add children or other family members onto the business records for tax reasons. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. Yes, a minor can own shares in an s corporation or generally own interest in an llc. The logic here is that.

Llc Holding Company Structure Diagram

However, given kiddie tax rates (even with the. Many tax professionals will add children or other family members onto the business records for tax reasons. Yes, a minor can own shares in an s corporation or generally own interest in an llc. The logic here is that the. Decide whether your child will solely own the llc or if it.

Can You Have Multiple Businesses Under One LLC?

However, given kiddie tax rates (even with the. The logic here is that the. Many tax professionals will add children or other family members onto the business records for tax reasons. Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. From a liability standpoint, why expose.

Can An Llc Do Business Internationally at Richard Gross blog

Decide whether your child will solely own the llc or if it will involve multiple members, such as parents or guardians. However, given kiddie tax rates (even with the. Yes, a minor can own shares in an s corporation or generally own interest in an llc. From a liability standpoint, why expose. Many tax professionals will add children or other.

Ask the Attorney Can I have multiple companies under one LLC? Seder

Many tax professionals will add children or other family members onto the business records for tax reasons. However, given kiddie tax rates (even with the. From a liability standpoint, why expose. Yes, a minor can own shares in an s corporation or generally own interest in an llc. The logic here is that the.

Yes, A Minor Can Own Shares In An S Corporation Or Generally Own Interest In An Llc.

However, given kiddie tax rates (even with the. From a liability standpoint, why expose. The logic here is that the. Many tax professionals will add children or other family members onto the business records for tax reasons.